8 FinTech Software Development Services That Drive Digital Transformation

Last updated: February 10, 2026 Read in fullscreen view

- 14 Jan 2026

How to Evaluate the Business and Productivity Software Company Seismic on RFP AI Agent Use Cases 84/97

How to Evaluate the Business and Productivity Software Company Seismic on RFP AI Agent Use Cases 84/97 - 11 Dec 2025

15+ US ReactJS Companies Shaping the Future in 2026 64/122

15+ US ReactJS Companies Shaping the Future in 2026 64/122 - 01 May 2023

Understanding Business as Usual (BAU) and How to Transition 52/930

Understanding Business as Usual (BAU) and How to Transition 52/930 - 21 Nov 2025

Top 8 Cloud Transformation Companies in USA in 2026 52/97

Top 8 Cloud Transformation Companies in USA in 2026 52/97 - 19 Oct 2025

10 Best AI SDR Tools Actually Tested by Sales Teams (2026) 47/118

10 Best AI SDR Tools Actually Tested by Sales Teams (2026) 47/118 - 02 Dec 2025

FIX vs. REST API: How to Choose the Right Integration Protocol for Modern Financial Systems 45/80

FIX vs. REST API: How to Choose the Right Integration Protocol for Modern Financial Systems 45/80 - 04 Feb 2026

Top Workflow Automation Services Driving Digital Transformation 44/55

Top Workflow Automation Services Driving Digital Transformation 44/55 - 21 Aug 2023

30 Must-Know IT Consulting Buzzwords Explained 39/54

30 Must-Know IT Consulting Buzzwords Explained 39/54 - 15 Dec 2025

What Does ERP-Friendly Mean? A Practical Guide for Modern Enterprises 36/67

What Does ERP-Friendly Mean? A Practical Guide for Modern Enterprises 36/67 - 27 Nov 2025

10 AI Tools Every Freelancer Should Use for a Side Hustle in 2026 30/94

10 AI Tools Every Freelancer Should Use for a Side Hustle in 2026 30/94 - 26 Jan 2026

Reliable Generative AI System Integrators to Work With in 2026 27/36

Reliable Generative AI System Integrators to Work With in 2026 27/36 - 29 Jan 2026

Why Headless Commerce Is Shaping the Future of the Online Store 27/35

Why Headless Commerce Is Shaping the Future of the Online Store 27/35 - 21 Aug 2025

Top 30 Oldest IT Outsourcing Companies in Vietnam 26/125

Top 30 Oldest IT Outsourcing Companies in Vietnam 26/125 - 02 Jan 2026

The Trust Paradox in Fintech: How Data Transparency Reduces User Anxiety in Financial Recovery 22/35

The Trust Paradox in Fintech: How Data Transparency Reduces User Anxiety in Financial Recovery 22/35 - 31 Dec 2023

Software Development Outsourcing Trends to Watch Out for in 2024 13/233

Software Development Outsourcing Trends to Watch Out for in 2024 13/233 - 23 Sep 2025

Top 10 eCommerce Website Development Companies in the USA 12/72

Top 10 eCommerce Website Development Companies in the USA 12/72 - 06 Jan 2026

Risk & Change Management Through the 3P Model 12/21

Risk & Change Management Through the 3P Model 12/21 - 03 May 2024

The Iceberg of Ignorance 10/403

The Iceberg of Ignorance 10/403 - 16 Jan 2026

Top 10 Most Trusted Web Development Service Providers in 2026 10/27

Top 10 Most Trusted Web Development Service Providers in 2026 10/27 - 05 Oct 2021

Shiny Object Syndrome: Why Your Business Isn't "Going Digital" 8/351

Shiny Object Syndrome: Why Your Business Isn't "Going Digital" 8/351 - 05 Jun 2025

Top Machine Learning Skills Employers Are Looking for in 2025 4/90

Top Machine Learning Skills Employers Are Looking for in 2025 4/90 - 23 Jan 2026

Top 10 AI Healthcare Software Development Companies in 2026 2/45

Top 10 AI Healthcare Software Development Companies in 2026 2/45

The financial services industry has reached a point where digital transformation has become an essential requirement. The banking industry along with payment companies and FinTech firms will face ongoing challenges until 2026 because customers demand more and regulations have become more complicated and digital-native competitors have emerged. The research conducted by McKinsey demonstrates that financial organizations achieve operational efficiency improvements of up to 40 percent through digital platform modernization while decreasing product development time for new offerings.

Organizations spend money on fintech software development services to achieve their modernization goals because they want to update outdated systems and create new digital products and expand their operations to multiple markets and distribution channels. The services provide essential technical support which enables organizations to achieve sustainable transformation instead of pursuing temporary innovation projects.

The following eight FinTech software development services help organizations in the financial sector implement digital transformation initiatives throughout their entire business operations.

1. Core Banking System Modernization

The current banking system restrictions which arise from its outdated core technology framework prevent banks from creating new banking services. The present core banking systems operate through design modularity which enables them to process real-time data and support application programming interfaces and cloud computing functions.

Core modernization typically enables:

- Faster product launches without system downtime

- Improved system stability and fault tolerance

- Easier integration with payment providers and third-party services

Financial institutions can achieve better regulatory compliance and market adaptability through the transition from monolithic systems to flexible architectural systems.

2. Digital Payment and Wallet Development

Digital payments are one of the strongest drivers of FinTech transformation. As such, according to Statista, by 2027, the transaction value of digital payments globally will finally exceed $14 trillion.

The payment and wallet development service typically includes:

- Mobile wallets for consumer and corporate use

- Contactless and QR-based payment systems

- The system enables cross-border transactions with multiple currency processing.

- The system secures transaction processes by using tokenization.

Well-designed payment systems enhance customer experience through support for scalability and fraud prevention.

3. Lending and Credit Automation Platforms

Digital lending platforms automate the three processes of loan origination and credit assessment and loan repayment. The process of automation enables organizations to complete tasks with less human effort while achieving more precise results.

Typical lending platform capabilities include:

- The system performs automated credit scoring by using both internal data and external data sources

- The system requires integration with credit bureaus and financial data providers

- The system provides digital identity verification together with document processing capabilities

- The system enables users to monitor their loan status in real time and receive status updates.

These systems create faster approval processes which enable more people to obtain financial services.

4. Financial Data Analytics and Reporting Solutions

Data-driven decision-making is the central point within digital transformation. FinTech analytics solutions support organizations in gathering and analyzing vast volumes of financial and behavioral information.

Some of the common analytics capabilities which can:

- Transaction and performance monitoring

- Risks and compliance reports

- Customer behavior and segmentation analysis

- Forecasting and trend identification

Well-presented data visualization enables quicker decisions as well as synchronization between technical and business groups.

5. Regulatory Compliance and Risk Management Software

Digital transformation relies on data-driven decision-making as its fundamental element. The FinTech industry faces its most difficult challenges through its regulatory compliance requirements. Financial organizations can maintain their compliance with changing regulations through dedicated compliance and risk management software which reduces their operational costs.

The main functions of compliance enforcement include:

- KYC verification automation. Identity verification through manual processes requires several hours or multiple days to complete. Verification processes achieve higher precision through automated workflows which shorten processing duration to minutes.

- AML and transaction monitoring. Real-time monitoring systems continuously analyze transactions to detect suspicious activities more quickly than staff members can conduct manual assessments.

- Real-time monitoring systems use continuous transaction analysis to identify suspicious activities which they detect more quickly than staff members complete their manual assessments.

- Audit trail generation. Businesses can use automated logging systems to retrieve log archives which help them conduct their internal compliance assessments and their regulatory audit investigations.

- Regulatory reporting. Automated reporting tools ensure accurate data submission through standardized formatting while minimizing human errors.

Through the use of automated systems which will replace their current manual compliance systems organizations will improve their audit preparation processes while reducing their compliance risks.

6. API Development and Open Banking Integrations

Open banking initiatives require APIs which provide both security and scalability capabilities. Financial organizations use API development services to connect with external providers while keeping their data access rights under control.

The API-driven transformation process enables organizations to achieve three main objectives which include:

- Faster onboarding of fintech partners

- Secure data exchange between systems

- New revenue models through third-party integrations

The development of structured APIs enables organizations to create new products while their existing systems remain operational.

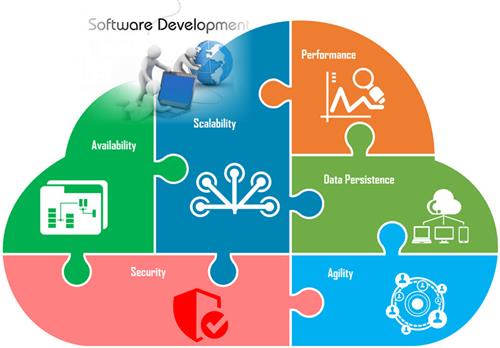

7. Cloud-Based FinTech Infrastructure

Cloud migration functions as an essential component that enables organizations to achieve scalability and maintain operational resilience. Organizations can use cloud-native FinTech platforms to dynamically change their infrastructure according to their current operational needs.

Cloud infrastructure services usually deliver these three main benefits to customers:

- High availability and disaster recovery mechanisms

- Faster deployment and update cycles

- Reduced infrastructure and maintenance costs

The cloud environments enable organizations to meet regulatory requirements through their capabilities for regional hosting and their systems of detailed access control.

8. Security and Fraud Prevention Systems

Digital transformation projects in FinTech depend on security as their fundamental requirement. The solutions for fraud prevention and cybersecurity protection establish proactive threat detection as their primary operational method instead of using reactive defense mechanisms.

The organization possesses essential security functions, which include:

- The system performs real-time fraud detection through its analytical capabilities of user behavior.

- The system uses secure methods for authenticating users and authorizing access to resources.

- The system protects data through encryption while monitoring who accesses information.

- The system performs ongoing surveillance of all operations and financial transactions which includes security monitoring.

Financial services organizations experience the highest average costs to recover from data breaches according to IBM'sCost of a Data Breach Report. Businesses need to spend money on security because this situation has become essential for their operations.

How These Services Enable End-to-End Transformation

The complete success of digital transformation relies on FinTech services functioning together as a unified ecosystem instead of existing as separate tools. The system requires all six components which include payments and lending and analytics and compliance and cloud infrastructure and security to operate through a shared architectural framework.

Organizations can grow their specific capabilities through a modular platform design which enables them to do so without affecting their overall operational system.

Choosing the Right FinTech Development Partner

Digital transformation success requires organizations to execute their plans effectively. Organizations should assess potential FinTech development partners based on these criteria:

- Proven FinTech domain expertise

- Experience with security and regulatory requirements

- Scalable and maintainable architecture practices

- Transparent delivery and communication processes

The strongest results come from long-term partnerships which organizations should choose over temporary outsourcing arrangements.

Final Thoughts

In 2026, financial services must embrace a complete digital transformation which extends beyond their current technological implementation. The process requires organizations to make unified investments in platforms which will enable them to create new products and meet regulatory requirements while building their capacity for future growth.

Organizations need FinTech software development services to build essential technical infrastructure which enables them to develop secure and robust financial products that will remain stable through upcoming challenges.

| About the Author | Yuliya Melnik | Technology writer | Yuliya Melnik is a technical writer at Cleveroad, a web and mobile application development company focused on FinTech software and AI-driven digital solutions. She writes about financial technology, digital transformation, and secure software development for regulated industries, helping decision-makers navigate complex FinTech platforms and compliance-driven systems. |

Link copied!

Link copied!

Recently Updated News

Recently Updated News