How Banks Can Use Cybersecurity Consulting to Build Customer Trust in the Digital Age

Last updated: November 28, 2025 Read in fullscreen view

- 12 Nov 2025

Top 10 Cybersecurity Service Providers in the USA for 2026 44/75

Top 10 Cybersecurity Service Providers in the USA for 2026 44/75 - 01 May 2023

Understanding Business as Usual (BAU) and How to Transition 22/843

Understanding Business as Usual (BAU) and How to Transition 22/843 - 19 Nov 2025

The Essential Cybersecurity Checklist for Hybrid Work IT Support 14/23

The Essential Cybersecurity Checklist for Hybrid Work IT Support 14/23 - 12 Oct 2022

14 Common Reasons Software Projects Fail (And How To Avoid Them) 10/504

14 Common Reasons Software Projects Fail (And How To Avoid Them) 10/504 - 28 Jul 2025

Data Modernization for SMBs: Small Steps, Big Impact 9/115

Data Modernization for SMBs: Small Steps, Big Impact 9/115 - 05 Aug 2024

Revisiting the Mistake That Halted Japan's Software Surge 6/322

Revisiting the Mistake That Halted Japan's Software Surge 6/322 - 14 Aug 2024

From Steel to Software: The Reluctant Evolution of Japan's Tech Corporates 6/488

From Steel to Software: The Reluctant Evolution of Japan's Tech Corporates 6/488 - 13 Oct 2021

Outsourcing Software Development: MVP, Proof of Concept (POC) and Prototyping. Which is better? 6/424

Outsourcing Software Development: MVP, Proof of Concept (POC) and Prototyping. Which is better? 6/424 - 28 Jul 2022

POC, Prototypes, Pilots and MVP: What Are the Differences? 6/606

POC, Prototypes, Pilots and MVP: What Are the Differences? 6/606 - 31 Aug 2022

What are the best practices for software contract negotiations? 5/215

What are the best practices for software contract negotiations? 5/215 - 05 Mar 2021

How do you minimize risks when you outsource software development? 5/317

How do you minimize risks when you outsource software development? 5/317 - 07 Oct 2025

Case Study: Using the “Messaging House” Framework to Build a Digital Transformation Roadmap 5/45

Case Study: Using the “Messaging House” Framework to Build a Digital Transformation Roadmap 5/45 - 02 Dec 2025

FIX vs. REST API: How to Choose the Right Integration Protocol for Modern Financial Systems 4/8

FIX vs. REST API: How to Choose the Right Integration Protocol for Modern Financial Systems 4/8 - 12 Dec 2021

Zero Sum Games Agile vs. Waterfall Project Management Methods 4/374

Zero Sum Games Agile vs. Waterfall Project Management Methods 4/374 - 04 Oct 2022

Which ERP implementation strategy is right for your business? 4/278

Which ERP implementation strategy is right for your business? 4/278 - 01 Dec 2023

Laws of Project Management 3/249

Laws of Project Management 3/249 - 03 May 2024

The Iceberg of Ignorance 3/336

The Iceberg of Ignorance 3/336 - 05 Sep 2023

The Cold Start Problem: How to Start and Scale Network Effects 3/167

The Cold Start Problem: How to Start and Scale Network Effects 3/167 - 18 Jul 2021

How To Ramp Up An Offshore Software Development Team Quickly 3/516

How To Ramp Up An Offshore Software Development Team Quickly 3/516 - 28 Oct 2022

Build Operate Transfer (B.O.T) Model in Software Outsourcing 2/361

Build Operate Transfer (B.O.T) Model in Software Outsourcing 2/361 - 17 Jun 2021

What is IT-business alignment? 2/343

What is IT-business alignment? 2/343 - 04 Oct 2021

Product Validation: The Key to Developing the Best Product Possible 2/295

Product Validation: The Key to Developing the Best Product Possible 2/295 - 08 Aug 2022

Difference between Power BI and Datazen 2/297

Difference between Power BI and Datazen 2/297 - 17 Mar 2025

Integrating Salesforce with Yardi: A Guide to Achieving Success in Real Estate Business 2/141

Integrating Salesforce with Yardi: A Guide to Achieving Success in Real Estate Business 2/141 - 01 May 2024

Warren Buffett’s Golden Rule for Digital Transformation: Avoiding Tech Overload 2/188

Warren Buffett’s Golden Rule for Digital Transformation: Avoiding Tech Overload 2/188 - 12 Aug 2024

Understanding Google Analytics in Mumbai: A Beginner's Guide 1/84

Understanding Google Analytics in Mumbai: A Beginner's Guide 1/84 - 19 Oct 2021

Software development life cycles /628

Software development life cycles /628 - 05 Oct 2021

Shiny Object Syndrome: Why Your Business Isn't "Going Digital" /303

Shiny Object Syndrome: Why Your Business Isn't "Going Digital" /303 - 06 Mar 2024

[SemRush] What Are LSI Keywords & Why They Don‘t Matter /131

[SemRush] What Are LSI Keywords & Why They Don‘t Matter /131 - 31 Jul 2025

Top WooCommerce Pre-Order Plugins with Countdown & Discounts /70

Top WooCommerce Pre-Order Plugins with Countdown & Discounts /70 - 19 Nov 2025

Cloudflare as the Internet Gatekeeper – Costs, Risks, and SME Solutions /31

Cloudflare as the Internet Gatekeeper – Costs, Risks, and SME Solutions /31

The banking sector, a data-focused industry, has a compulsion to keep its users’ information safe. Account details, transaction information, and other payees' data are the focus points of cyberattackers. They can use it for money scams and identity theft. While these are why cybercriminals look for tamper-proof vulnerabilities, banks and finance businesses are expected to stand their ground against such attacks.

In such situations, bank-focused decision-makers are expected to build an architecture that is resilient and brings forth safety regardless of the attack intensity. That being said, they are opting for cybersecurity consulting services and location anomalies that defend their systems. But the question that arises is how they make that happen. In that case, we must assist you in understanding how bank-based businesses are making this happen.

With this bifurcation, you will come across the features and functionalities that are assisting businesses in making a safety-proof transformation. For more information, let us dive in and assess different strategies that build breach-proof systems.

How Banks are Building Customer Trust With Cybersecurity Consulting Services?

This section holds value in the context of the strategies that businesses are opting for when ensuring the protection of their bank's data and user information. With features and functionalities that ensure data integrity, you can make the necessary changes and protect your business from cybercriminals.

1. Risk-Based Security Assessment

The primary assessment that a cybersecurity consulting services provider does is to analyze the entire business architecture to look for risk-based endpoints. When exposed, these endpoints work as a backdoor for the cyberattackers and assist them in breaking the security system. Even a vulnerable credential can be considered a security breach and can make a way for hackers to penetrate the system.

These services ensure that your system does not have such vulnerabilities and look for risk-based points. Once done with that, they provide the banks with remediation strategies to fix it and make it breach-proof.

2. Data Encryption And Privacy Architecture

As mentioned above, you need to ensure that your architecture is secure from possible data breaches. That can occur because of data leakage through different sources that can be used by attackers.

However, when banks implement data encryption, they enclose any possible leakage with monitoring and shortcomings detection. This way, you can have secure systems where the data cannot be accessed by anyone outside of the bank.

3. Secure API Management

Oftentimes, it is observed that attackers enter the banks and their architecture through unprotected third-party APIs. They locate the flaw in the vendor’s system and break through it to penetrate the bank's system. If such API are not secured, they have a high probability of allowing hackers to enter and install malware.

In those cases, banks are expected to secure their APIs from third-party vendors or verify the measures taken by them before integrating their APIs. This way, you ensure that your data integrity is maintained and customer trust is built.

4. Zero Trust Framework Design

Zero trust framework is built on the idea that no one is authenticated to access data until and unless they clear the authentication check. Even if you are an insider or an executive member of a company, you cannot access confidential or sensitive data unless and until you verify your identity.

Banks follow these steps to ensure that no one, internally or externally, can penetrate the system and go unnoticed. This way, banks choose a zero-trust system and ensure that their users access their files with full authentication. They opt for cybersecurity consulting services and make sure their banks stay protected.

5. Red and Blue Team Simulations

It is seen that mostly banks and finance firms face issues because of untrained employees with zero understanding of cyber threats. Cybercriminal attacks the system with social engineering techniques like phishing and malware attacks and compel the employees to click on links. Even if just one of them clicks on it, the cyberattacks can penetrate the system and hack into the data with ease.

To ensure the bank’s situation does not reach that point, they can simulate real-world attacks to assess the understanding of their employees and assist them with training. This method is called Red teaming, where experts attack the system to educate the employees of possible consequences and how to safeguard with cybersecurity consulting services.

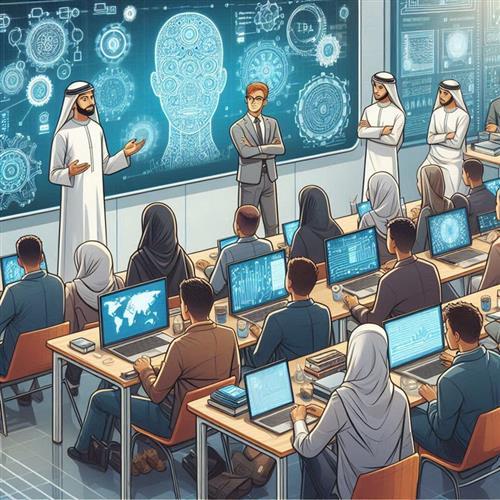

6. Employee Security Training Enablement

As we mentioned, not everyone is aware of how cyberattackers penetrate the banks’ digital solutions, and this is where the decision-makers should take the initiative. To make the employees understand how to identify an attempt, banks go ahead with training them and providing them with cybersecurity awareness training.

This way, banks ensure that employees don't fall prey to such attacks and schemes, and hamper the security measures taken by the banks.

Significant Benefits of Cybersecurity Consulting Services for Banks

Since we understand the ways in which the banks are making sure that their baseline stays unpenetrated and safe, they are building trust among the users. With security measures here and there, it is obvious that businesses are making a change. That being said, it is better to understand that more aligned benefits come with a cybersecurity-proof FinTech app development company. With this tabular version, you might get a better understanding of the advantages.

| Benefit | How Cybersecurity Assists? |

|---|---|

| Customer Trust Amplification | Builds transparency and confidence with secure systems and proactive communication. |

| Regulatory Compliance | Ensures alignment with RBI, GDPR, PCI DSS, FFIEC, and other banking regulations. |

| Brand Protection | Prevents reputation damage by reducing breach risks and improving incident response. |

| Operational Resilience | Strengthens business continuity through preparedness, detection, and rapid recovery. |

| Secure Digital Transformation | Enables safe rollout of new technologies like AI, cloud, and open banking APIs. |

| Third-Party Risk Management | Identifies and secures vendor relationships, especially in open and connected ecosystems. |

| Employee Risk Reduction | Minimizes human error through continuous training, simulations, and awareness. |

| Data Privacy Enablement | Embeds privacy by design through encryption, data governance, and consent-based controls. |

| Faster Incident Response | Provides tested protocols and tooling for fast threat detection and mitigation. |

Conclusion

As we wind up, we hope that our bifurcation has assisted you in understanding how cybersecurity consulting services are ensuring that the customer’s trust is being built. Keeping the necessary strategies in mind, banks and finance companies are making efforts to detect threats and ensure full-fledged safety.

| About the Author | Linda William | Cybersecurity Professional | Linda William is an experienced cybersecurity professional offering her services to the banking industry. She assists finance firms in making better safety-focused decisions and safeguarding their brands. |

Link copied!

Link copied!

Recently Updated News

Recently Updated News